Table of Content

Whatever your situation may be, we can help put a solution together to help you pay off your home loan faster and pay less interest. Most people opt for a 25-year term when they get their first mortgage, but that isn’t necessarily the right choice for you. Buying a home is a big step, and paying for it is not a decision you make every day. To help explain the important pieces, we've presented some popular tips and tools below.

The amount of mortgage you need will depend on how much the house is and how much money you can put towards a deposit. For example, if you have a $100,000 deposit and the house you want is $500,000, you will apply for a $400,000 mortgage. An interest-only mortgageis just as its name suggests; your ongoing repayments will only be paying off the interest on the mortgage, and won’t repay any of the loan amount. As a result, your monthly repayments will be lower, but you’ll have to repay the entire mortgage amount at the end of the term .

Re-fix your home loan

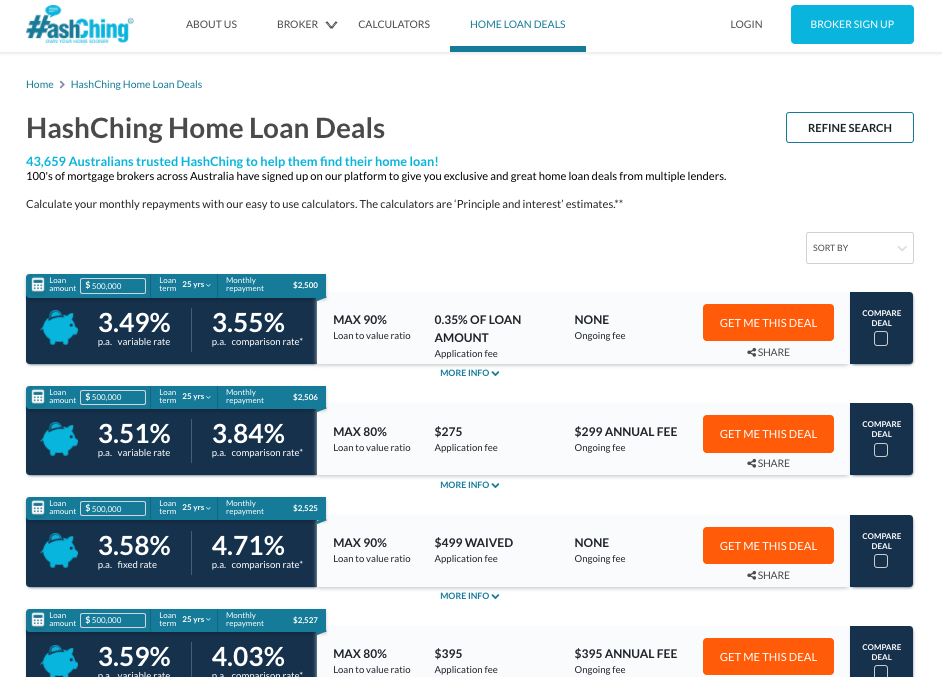

Our list of home loan offers applies to first-time and existing homeowners looking to refinance or buy a new home. Reach your home buying goals faster with a range of repayment options - choose between a table loan, a reducing loan, a revolving credit loan or an interest only loan. Clickhere to view the Canstar Home Loans Star Ratings Methodology. The current features, rates and fees are displayed and may be different to what was rated. The Star Rating shown is only one factor to take into account when considering a product.

You can get a mortgage from either a bank or a mortgage broker. You can also get home loans from ‘non bank lenders’ such as building societies, finance and insurance companies, trustee companies and credit unions. If you’ve suffered a bad credit rating, then you can also get a mortgage from a non-conforming lender.

What is an owner-occupier home loan?

The term of the loan is five years, which is the same as the interest-only period set for the base loan. During this time you can make extra payments at no extra cost, to pay off the loan faster. In the years before pandemic-induced, ultra-low interest rates, cash incentives from banks to lure new home loan customers were commonplace.

Pre-approval will give you a realistic idea of how much you can borrow, and how much deposit you need. It won’t tell you a lot about what sort of deal you’ll get as rates and cash backs are negotiated when you put a house under contract and before mortgage documents are finalised. When you use glimp, you’ll not only be able to find a mortgage with lower rates and that you can pay off earlier, but you also won’t have to pay a cent to find that deal! Our comparison tool is free to use, so you can find your best mortgage rate at no added cost. The calculations for Monthly Payment Amount and Annual Comparison rate are based on a principal amount of $250,000 and a term of 30 years. These figures take into account the Advertised Interest Rate, Upfront Fees and any Monthly Fees.

BNZ Classic 2 Year Fixed

All interest rates are subject to change without notification. All offers can be changed or withdrawn at any time without notice. We’ll then review and assess your application and determine how much you can borrow, based on certain conditions.

A fixed interest rate is where you lock in an interest rate for a set term from six months up to five years. This provides certainty around your repayments and protects you from any increases in market interest rates during this fixed term. A report from an authorised agency that shows the potential borrower’s credit history.

Buying an investment property

Westpac offers a $5000 cash incentive on new residential home loans, as long as the loan is for at least $500,000 and you have a minimum 20% deposit. The Co-operative Bank doesn’t offer cash incentives, although it does offer a FHB special rate of 4.99% p.a. For one year fixed, on new lending from $200,000 with a 20% deposit. The offer is also available for Kāinga Ora First Home Loans.

If you choose a longer term, there’s always the chance floating rates will dip to below the fixed rate you’re paying. Below you’ll see a summary of the home loan interest rates and terms currently offered by many of New Zealand’s top lenders. The offers have been grouped into lender types which you can sort by term or rate. For a quick glance at todays best rates, view the top 6 rates here. With more capital changes in the pipeline, the rate difference between investment property and owner-occupied property is likely to become greater.

First, you meet a mortgage adviser and get an assessment done to see how much you can borrow. We make the complex home loan process simple in Auckland,NZ which saves your time. Our advisers show you the right path by carefully listening to your specific needs thereby, helping you find the best deals.

Home Loans earlier in the year. To simplify your financial life and pay less interest, you may be able to consolidate other borrowing into your floating rate home loan. A revolving credit mortgage works a little like a large overdraft. You’re free to make repayments whenever you like, plus you can withdraw money up to your credit limit when you need to. When purchasing an owner-occupied property you can generally borrow around five times your gross annual income. Lenders will require evidence that you're in a position to service the mortgage based on paying it off over 30 years, and at a mortgage rate of around 7.50% .

– Fee charged for a professional opinion about how much a property is worth. Canstar’s home loan updates are a great place to keep up-to-date and informed about everything that’s happening in the real estate market. You’ll get an ANZ Home Loan Coach to support you through the buying process. Plus, we have a range of helpful tools available to you throughout your home buying journey.

This can be over video call, face-to-face, in-branch, over the phone, or one of our Mobile Mortgage Managers can visit you wherever suits. We've outlined below everything you need to do and consider when you switch your home loan to us. Buying your first home is a big deal, a memory you'll cherish your entire life. Interest rates are on the rise, so best to lock in a rate sooner than later. We can help with insurance options that ensure you and your family are protected no matter what.

No comments:

Post a Comment